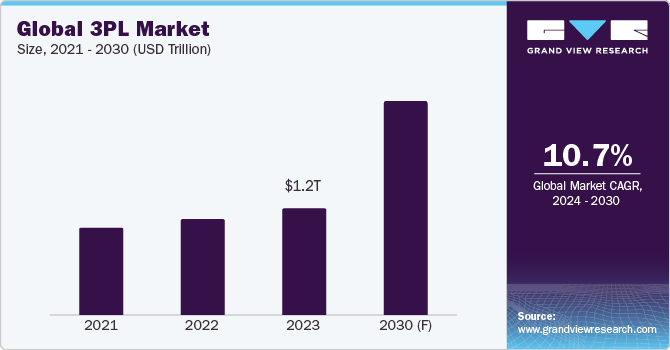

Third-party Logistics Industry Procurement Intelligence 2020-2025: Global Market Development, SWOT Analysis, Challenges, Opportunities, Supply, Demand and Key Companies Overview

Third-party Logistics Industry Category Intelligence

The continuous shift to e-commerce due to pandemic have fueled the need of robotics and automation solution across third-party logistics services for global organizations. However, these automation integrations take months largely because the software that operates them must be manually configured to work with an individual warehouse management system. DHL in collaboration with Blue Yonder is installing robotics solution, programmed with the ability to speak to different systems, removing the need for software configuration at each warehouse. This robotics hub would operate as middleware between the warehouse management system and the fleet management system. It standardizes the data and tasks that flow between the two systems such as, shelf location of a retail product, the quantity of a product to pick, etc.

Similarly, C.H. Robinson integrated 19 transportation management systems (TMS) and enterprise resource planning (ERP) systems into the company’s global multimodal transportation management system, Navisphere. This integration offers access to real-time pricing and capacity assurance and nearly eliminates the time required to get market quotes and book loads, making this a virtually instantaneous process. This integration offers access to real-time pricing and capacity assurance by eliminating the time required to get market quotes and book loads. This automation also provides greater flexibility and efficiencies for shippers at a critical time when they are faced with changing customer buying habits and supply chain disruptions such as COVID-19.

Third-party Logistics Industry Category Intelligence Highlights

- 3PL suppliers are collaborating with regional players to benefit from their knowledge of the local market, and maintain high-profit margins, low overhead costs, and their overall competitiveness in the market

- The Third-party Logistics market features a highly fragmented competitive landscape and several small players are entering the market

- Suppliers widely prefer approved provider operating models to reduce risks and improve the potential for value creation

- Growing adoption of Transportation Management System (TMS) is aiding to the growth of the third-party logistics market

- The global 3PL market is highly fragmented and competitive, with many large corporations striking strategic partnerships with mid-sized or small-sized companies to leverage their regional logistics capabilities

- Though cost transparency is lower, cost plus pricing model is offered by the suppliers to maximize profits with less management complexities

- The Chinese government has lowered transportation costs for export and import enterprises temporarily as part of the efforts to ensure that work is resumed as soon as possible and the foreign trade sector remains afloat amid the outbreak of the COVID-19 pandemic

Grab your copy, or request for a free sample of the “Third-Party Logistics Industry Procurement Intelligence Report, published by Grand View Research” for In-depth details regarding supplier ranking and selection, sourcing, and pricing criteria & startegies

Third-Party Logistics Services:

- Dedicated Contract Carriage

- Domestic Transportation Management

- International Transportation Management

- Warehousing and distribution

- Value-added logistic services

Third-Party Logistics Industry – Pricing and Cost Intelligence:

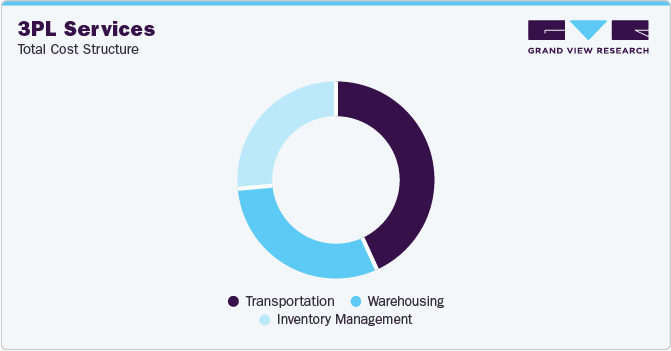

Grand View Research has identified the following key cost components for availing 3PL Services:

- Transportation

- Road

- Sea

- Air

- Rail

- Warehousing

- Order Picking

- Storage

- Shipping

- Receiving

- Others

- Inventory Carrying and Administration

- Insurance

- Freight

- Service Fee

- Storage

- Admin

Warehousing and transportation are the major cost components of a 3PL Services, accounting for more than 70% of the total cost of service.

Third-Party Logistics Industry – Supplier Intelligence – Capability based ranking & selection criteria with weightage:

Operational Capabilities –

- Years in Service – 15%

- Geographical Service Presence – 35%

- Employee Strength – 12%

- Revenue Generated – 12%

- Key Industries Served – 18%

- Certifications – 9%

Functional Capabilities –

- Service Offerings – 50%

- End-to-end service

- Warehousing

- Transportation

- Distribution

- Shipping and receiving

- Transport Method – 30%

- By road

- By railways

- By sea

- By air

- Technology Adoption – 20%

- High

- Medium

- Low

List of Key Suppliers in the third-party logistics market

- DHL International GmbH

- FedEx Corporation

- Kuehne + Nagel International AG

- United Parcel Service

- C.H. Robinson

- XPO Logistics

- Nippon Express

- DB Schenker

- Sinotrans Limited

- Expeditors

Add-on Services provided by Grand View Research Pipeline:

Should Cost Analysis

In the 3PL Category Intelligence study, we have estimated and forecasted pricing for the key cost components while availing services from 3PL organizations. Transportation is the largest cost component of 3PL service. Road transportation accounted for more than 75% share in overall transportation cost, which is majorly driven by crude oil price fluctuations. Crude oil prices increased from USD 40/barrel in 2016 to USD 70/barrel in 2018 before it was hit by the Covid-19 pandemic, resulting in price dropping to USD 19/barrel in 2020. Due to this, The Organization of Petroleum Exporting Countries were forced to cut the supply of crude oil in 2020. However, crude oil prices have been steadily rising through the start of 2021, and this is expected to continue in 2022, which will result in further hike in crude oil price, eventually increasing transportation costs

Rate Benchmarking

The size of the container is one of the most important aspects while analyzing the rate benchmarking of a 3PL service. In our research, we have analyzed the rates of 20ft and 40ft containers in the U.S. By using rate benchmarking analysis, we found that using a full load 40ft container is 17-18% more cost-efficient than using two full load 20ft containers. On the other side, 20ft containers are suitable for heavy cargo (Minerals, metals, machinery, sugar, paper, cement, steel coils etc.) and 40ft containers are suitable for voluminous cargo (Furniture, steel pipes, paper scrap, cotton, tobacco etc.). Hence, two 20ft containers can carry double the weight of a single 40ft container.

To gain a comprehensive understanding of the other aspects of rate benchmarking, please subscribe to our services for the complete report

Salary Benchmarking

Labor is one of the key cost components incurred while offering a product or service. Understanding the pricing structure of salary is important for organizations in selecting the appropriate supplier and to build a good negotiation strategy. It is also an important factor in determining whether the category under focus should be outsourced or built in-house.

Our research indicates that FedEx operations managers earn 20% higher salaries than operations managers from industry leaders like DHL, Kuehne + Nagel. However, the YoY increment rate in such companies largely depends on KRAs.

Supplier Newsletter

It is cumbersome for any organization to continuously track the latest developments in their supplier landscape. Our newsletter service helps them remain updated, to avoid any supply chain disruption which they may face, and keep a track of the latest innovations from the suppliers. Outsourcing such activities help clients focus on their core offerings.

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

Browse through Grand View Research’s collection of procurement intelligence studies:

- Contract Research Organization Market – The global CRO market is expected to witness sustainable growth (CAGR of 6.4%) from 2020 to 2025 due to the increasing global need for drug development and investments by pharma giants in R&D, owing to the patent expiration of blockbuster drugs.

- Sugar Processing Market Procurement Intelligence – The global sugar processing market was valued at 166 million MT in 2020 and it is expected to grow at a CAGR of ~2% from 2021 to 2027 to cross 200 million MT in terms of volume in 2027. The growth of the market is majorly driven by the high demand generated from the food and beverages industry.

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/pipeline/3pl-market-procurement-intelligence-report